Popular posts from this blog

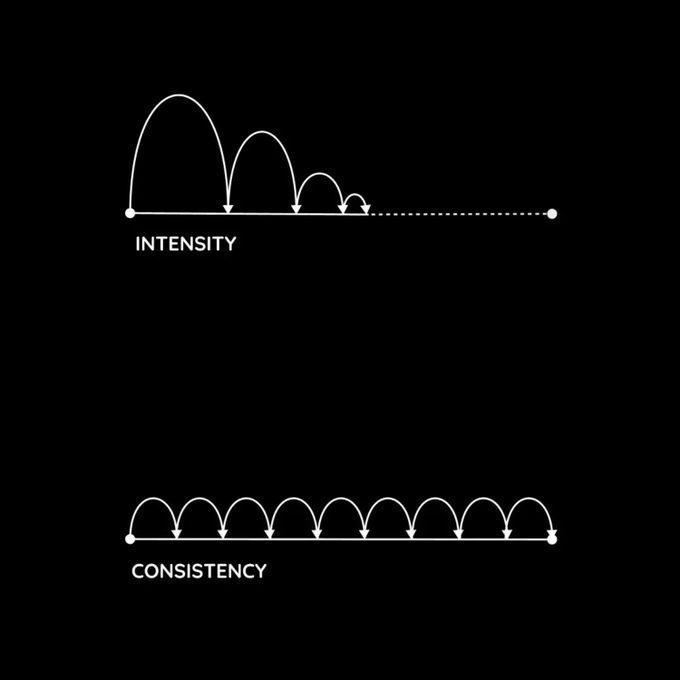

Cycles within cycles

Since times immemorial, man has been a witness of the cyclicality of nature and of life. It starts with your pulse, your heart beat, the pace of your breathing, the daily sun sets, the tides and the moon, the seasons etc, a surrounding all encompassing cycle of births, growth spurts, maturity and decay, all dictated by the same thermodynamic law of entropy, a booming spark of chaotic energy that eventually gets diffused into orderly cold matter. This same universal clock of ascending and descending energy is at work in markets and is what the great technicians Charles Dow, Ralph Nelson Elliott and William Gann have described over centuries. They too noticed the fractal nature of market cycles, made of long ascending and descending primary trends, themselves made of ascending and descending intermediary trends, themselves made of smaller trends etc. In brief, cycles within cycles. This dialectical historical mechanics is the way of the Tao or what...

Kitchin and presidential cycles

Divide a Juglar or an Armstrong cycle by two and you get what is known as Kitchin cycle, a 4 to 4.5 year cycle, also known as the “presidential cycle”, because it coincides with the electoral clock of the United States, the world’s leading economy and home of the world’s reserve currency. There is no doubt that the interactions between the fiscal and monetary cycles are major factors in monetary aggregates and as such do influence the US dollar and therefore pretty much every asset classes. That said, whether the political cycle is the cause or the result of a wider and more complex socio-economic machine remains a matter of debate. Politicians would be the first to take credit for any economic upswings and blame the downturn on the cycle itself. Like Kondratieff in his times, the purpose of this post is not to explain, but to expose a cycle that effectively corresponds to the bull-bear cycles of most equity markets and therefore, the average length of bull...

Comments

Post a Comment