K waves

We owe to Schumpeter the rediscovery of Kondratieff’s work. Kondratieff had

died twenty years earlier in 1938 in a goulag prisonier camp in Siberia. He died for

his simple but powerful economic findings.

Little did young Nicolai Kondratieff know that his discovery would seal his

fate. Hired by Lenin to find the scientific proof that the a major crisis

would eventually destroy capitalism , Nicolai Kondratieff was a man on a

mission.

His study of more than a century long of a twenty plus economic data series covering

the wholesale and retail prices of goods, wages, interest rates, industrial data

across six of the largest economic powers of the time (France, UK, US and Germany) over more than a

century was the achievement of a titan, considering the lack of computerised

centralised recipient of such data at the time.

Nikolai Kondratieff thought of his work as a scientific endeavour. He did

not try to explain. He first tried to gather data and observe them. Once assembled,

what he saw was a form a Eureka moment. It was there for everyone to see: long

waves of ascending prices and interest rates, followed by plateaus and then

long period of descending prices and interest rates spanning periods of fifty

years plus or three waves between the end of the XVIII century and the 1920’s.

His first papers reported his theory of a 54 years average long cycle between 1922 and

1928. His book on Major Economic Cycles was translated in German and for posterity in 1925. Because his findings did not concur with the original goals of his

master, Stalin, he was trialled and deported in 1932 for treason and pro-market views.

What had scared Stalin was the proof that politics is a sideshow, a derivative of more powerful unassailable cyclical forces at work. Revolutions come and go. Technologies are replaced by better

ones. The historic wheel shows that change is the only constant and that it obeys an historic clock

driven by global forces that no utopia can stops.

Capitalism for all its sins

had survived each of these phases of booms and busts. It had in fact got

stronger in the process, for capitalism is not an utopia but is based on human nature. It's an self-adaptive process and like the phoenix has self regenerating power.

Kondratieff never had the chances to explain what was behind these cycles. The origins of K waves are still a matter of debate. However, these seem to influence

all aspects of society in a interlinked self reflexive cycle from general price movements, to interest rates, GDP, demographic, technological revolutions, social moods, stock market trends etc.

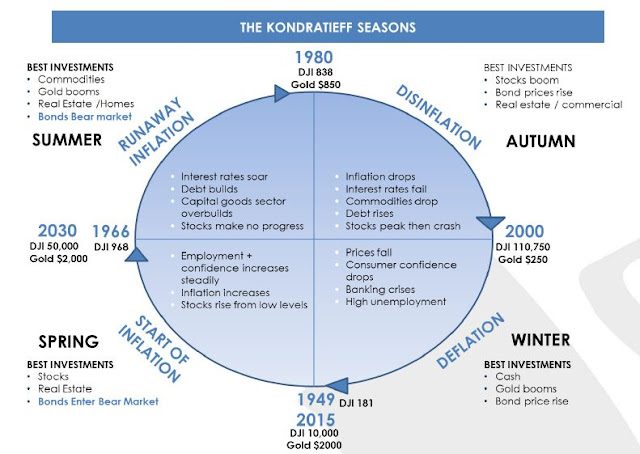

The first three waves identified by Kondratieff spanned periods of 54 years on average each and can be described through a cyclical process of four easily identifiable seasons.

Spring is characterised by a period of moderate growth, modest inflation

and a good period for stocks. Summer is characterized by accelerating growth

and high inflation (generally bad for bonds and PE). Autumn is characterized by

declining inflation and asset bubbles (falling bond yields and rising PE).

Winter involves the collapse of the asset bubbles and deflationary bear markets

(the period we have been living in since the collapse of the internet bubble), a period of excess supply of goods and deflationary forces linked to

technology revolutions and abundance of resources. In parallel, falling

fertility rates and ageing of the population, driving glut of savings first and

lower productivity second.

The length of each seasons varies. Spring tends to be fairly long, perhaps 20 years, as innovation get adopted and new capital gets invested creating growth and gradual appreciation of prices. This phase then plateaus in boom phases and high inflation periods of ten years. The excesses caused by these period are then followed by a twenty year period of disinflation finishing off in periods of deflation and crises.

Albert Aftalion illustrated this lagging

effect with the allegory of the coal burning heating device. When the room is

too cold, the occupier puts more coal to heat the room up and does add fuel

until the heat rises to its taste. But the heat continues to rise as the coal

burns further , such that the room is now too hot. The occupier stops putting

coal in the chamber.Temperature falls, until the occupier starts feeling cold

again.

The 1st K-cycle: 1790-1844 (54 years) starts with an ascending price period lasting to the end of the Napleonic wars in 1814

and a period of descending prices culminating in 1848, the period between

1847-1848 being characterized by a series of revolutions and crises across the

World. Technological innovation like the steam engine dominated this cycle. Billionaires were steal mill owners and transportation and railway moguls.

The 2nd K-wave starts in 1845 and lasts until 1896 (51 years), the first ascending phase lasting until 1873 (Franco-Prussian

war) followed by a disinflation-deflationary phase lasting to 1896. Discoveries such as electricity and oil were key technological innovations then. Rockfeller become the richest person in the world.

The third wave starts in 1896 was

ongoing when Kondratieff was studying, the rise in prices culminating in 1920

and therefore heralding a period of disinflation in the 1920’s (the roaring

1920’s) and deflation in the 1930’s (the Great depression) finishing with WW II and its aftermath (1948 end?). Automotives and chemical innovations were amongst the most important innovations. Think of the Fords and the Duponts.

The fourth wave started in the aftermath

of the WW2, demographic boom, technological revolution in chemicals,

electronics and resources aplenty, then last the end of the 2000’s.

It would be wrong to assume just because the beginning of Kondratieff's study starts with the beginning of the industrial revolution that K-waves are an industrial phenomenon. Indeed, commodity cycles like seasons have been known since the dawn of humanity. (Modelski and Thompson have identified K-Cycles that go back to the Sung Dynasty in China between 930-1250 AD.)

The analysis of these waves are not an exact science, nor does it claims to be. Such cycles must be understood less as a precise historic clock and more like a roadmap of general conditions at work. These self reflexive evolutionary patterns would have a tendency of repeating themselves and reveal the interactive influences of what we would describe as the four drivers of history (demographics, technology, resources/environmental, social/political) on the economy and asset classes.

The current debate is whether we have started a new K wave Spring or still ending a K-Winter. After all governments and central bankers are doing all they can to delay the painful ‘pay-back’ period which is the feature of all previous cycles. There is no way of avoiding the final collapse of a credit boom. The only question is whether it comes sooner as a result of a engineered controlled recession (to reduce the excesses and re-align the imbalances) or later as a total catastrophe.

The current cycle, which is already longer than average. It can be explained by the fact that average life expectancy has increased or that the US dollar is the world’s only reserve currency and is free from its old gold peg as well as to globalization. We shall refrain to make a prediction, but at least we are a prepared.

The pattern that followed the burst of the internet bubble are indeed classic Kondratieff stuff and the Winter that followed is consistent with the historic lows reached in the interest rates. The good news is that twenty years on, we have gone a long way already. The bad news is that the excesses are for everyone to see in terms of the ratios of "wealth" / GDP and debt/GDP.

Comments

Post a Comment