Generational cycles

Even if the length and the drivers of Kondratieff cycles are stillmatter of debates, the fact of the matter is that such cycles can be split into two or four blocks or what we call Generational cycles.

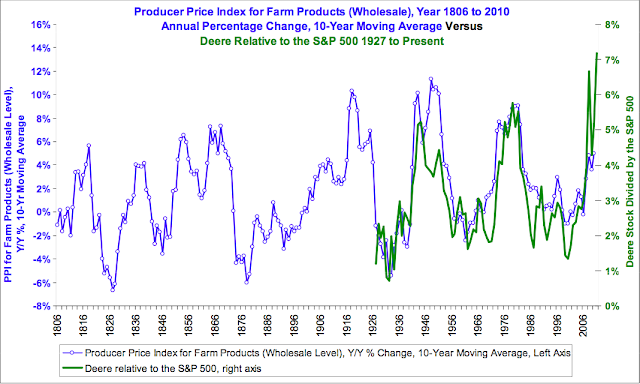

26-30 years plus cycles are typically the length of commodity "super cycles"

14 to 18 years are what also referred to as Benner and Kuznets cycles, which are typically the length of secular bull or bear markets.

The duration here are less about time than about the prevailing conditions of that time period. It's the same as the weather. Snow falls don't have to wait for the official start of winter. Intriguingly enough, the French use the same word "temps" for both weather and time.

As the grand daddy of all asset classes, commodities classic supply demand cycles have been studied over centuries. They do span 28-30 years, with twelve years of booms and eighteen years of excess capacity within longer 54-60 year cycles.

Amongst commodities, gold is the monetary gauge, the barometer for real money value of real interest rates. Gold performs in periods of hyperinflation and deflation. Gold cycles do span 18 years, twelve years bull runs followed by five years downturn.

In equities, the 14-18 year Benner cycle is best illustrated by the length of secular equity bull and bear markets, bear markets being typically quicker than bull markets.

Don't be surprised therefore if people may see in it a warning sign. After all, we are seeing the Nasdaq getting more volatile after it peaked almost exactly on this 17.6x year cycle, just as oil reached a new low. History does not repeat itself, but it rhymes.

Both identified clear social moods and generational shifts, defining themselves with the previous ones and representing, with ramifications in the arts, politics, consumer behaviours, capital formation and technological adoption and echoing Jean Baudin's quote that man is the only source of wealth.

26-30 years plus cycles are typically the length of commodity "super cycles"

14 to 18 years are what also referred to as Benner and Kuznets cycles, which are typically the length of secular bull or bear markets.

The duration here are less about time than about the prevailing conditions of that time period. It's the same as the weather. Snow falls don't have to wait for the official start of winter. Intriguingly enough, the French use the same word "temps" for both weather and time.

As the grand daddy of all asset classes, commodities classic supply demand cycles have been studied over centuries. They do span 28-30 years, with twelve years of booms and eighteen years of excess capacity within longer 54-60 year cycles.

Amongst commodities, gold is the monetary gauge, the barometer for real money value of real interest rates. Gold performs in periods of hyperinflation and deflation. Gold cycles do span 18 years, twelve years bull runs followed by five years downturn.

In equities, the 14-18 year Benner cycle is best illustrated by the length of secular equity bull and bear markets, bear markets being typically quicker than bull markets.

Don't be surprised therefore if people may see in it a warning sign. After all, we are seeing the Nasdaq getting more volatile after it peaked almost exactly on this 17.6x year cycle, just as oil reached a new low. History does not repeat itself, but it rhymes.

Studying generational cycles would not be completewithout mentioning the work of Bob Prechter on "Socionomics" as well as Strauss and Howe (the "Fourth turning".

Both identified clear social moods and generational shifts, defining themselves with the previous ones and representing, with ramifications in the arts, politics, consumer behaviours, capital formation and technological adoption and echoing Jean Baudin's quote that man is the only source of wealth.

Heroes

|

Artists

|

Prophets

|

Nomads

|

1840-1860

|

1860-1880

|

1880-00

|

1900-20

|

1920-1940

|

1940-1960

|

1960-1980

|

1980-00

|

2000-2020

|

2020-2040

|

2040-2060

|

2060-2080

|

Comments

Post a Comment